Table of Content

If you’re married and filing jointly, you won’t pay capital gains on the first $500,000. Assuming you meet the ownership and use tests, if you’re single, you don’t need to pay capital gains taxes on the first $250,000 of profit from the home sale. If you’re married and filing jointly, you’re exempt from taxes on the first $500,000. A 1031 exchange allows you to roll over profits from a second home sale into another investment property within 90 days of selling and defer capital gains tax liability.

What may seem like something challenging to you and me is easy for those in the tax industry. As long as you still have the receipts, the IRS will consider this when calculating the capital gains due. It’s essential to keep in mind the IRS considers your primary residence to be somewhere you have lived for at least two out of five years before the sale. If this is the case with your second home, you could receive an exclusion. This means you haven’t lived there for the two years of the five before selling.

Don’t Forget Property Tax Deductions With The Sale of a Second House

If you have a rental property, you can move into it and make it your primary residence. The sale of the home will qualify for capital gains exclusion after you’ve owned and lived in it as your primary residence for two years. You are taxed on any profit if you sell your home within two years of buying it. If you hold the property for one year or less , you’re liable for short-term capital gains, which are taxed as ordinary income. You’ll pay the same federal rate on these gains as on wages and other earnings — ranging from 10–37%, depending on your household income.

Even if you don’t meet the requirements for Section 121 exclusion, there are other ways to trim your capital gains tax burden or avoid it entirely. But these strategies involve the sale of an investment or rental property, rather than a primary residence. You have to meet certain requirements to be eligible for this tax exemption, though. And if you’re on the hook for capital gains taxes, the rate can be significant — up to 37% of the gains, depending on your filing status and how long you hold the house before selling it. If you’re facing a hefty capital gains tax burden, you’ll want to explore ways to legally avoid or reduce your taxes. If you sell property that is not your main home that you’ve held for more than a year, you must pay tax on any profit at the capital gains rate of up to 20 percent.

Tax tips for taxpayers to consider when selling their home

Because gains on non-principal residences and rental properties do not have the same exclusions, people have sought for ways to reduce their capital gains tax on the sale of their properties. One way to accomplish this is to convert a second home or rental property to a principal residence. The Taxpayer Relief Act of 1997 significantly changed the implications of home sales in a beneficial way for homeowners. Before the act, sellers had to roll the full value of a home sale into another home within two years to avoid paying capital gains tax. However, this is no longer the case, and the proceeds of the sale can be used in any way that the seller sees fit.

I would recommend them to anyone who is looking for a reliable property management company. They had people popping up to the home with no warning to view the property while we were still living there and I was working from home so you can just imagine how inconvenient that was. This is my 3rd review and each time LPC throws a fit for me to remove it so that I won't hurt their 5star rep. This is my experience and my experience alone with the company. Are you sure there aren’t any sentimental reasons not to sell it? Before you sell your property and worry about taxes, ask yourself if you truly want to say goodbye to the single-family home that you grew up in.

How Much Capital Gains Tax Will You Owe to The IRS?

The 20 percent maximum capital gains rate applies only to the $20,000 gain remaining, Levine said. When selling your primary home, you can make up to $250,000 in profit or double that if you are married, and you won’t owe anything for capital gains. The only time you will have to pay capital gains tax on a home sale is if you are over the limit. If you or your family use the home for more than two weeks a year, it’s likely to be considered personal property, not investment property. This makes it subject to taxes on capital gains, as would any other asset other than your principal residence. Military personnel and certain government officials on official extended duty and their spouses can choose to defer the five-year requirement for up to 10 years while on duty.

And the profits are taxable if they exceed $250,000 for single filers or $500,000 for joint/married filers. A 1031 exchange allows you to defer paying capital gains taxes when you sell one investment property and use the proceeds to buy another. The other property must be of “like-kind,” which generally means any piece of real estate can be exchanged for another piece of real estate, as long as they’re held for investment purposes. Single people can exclude up to $250,000 of the gain, and married people filing a joint return can exclude up to $500,000 of the gain.

Wait at least two years before claiming the exemption between sales of a primary residence. Own the home and live in it as your primary residence for at least two non-consecutive years out of the five-year period prior to the date of sale. The seller must have owned the home and used it as their principal residence for two out of the last five years . Also, if the grantee has ownership in the house, the use requirement can include the time that the former spouse spends living in the home until the date of sale. The FMV is determined on the date of the death of the grantor or on the alternate valuation date if the executor files an estate tax return and elects that method. You must not have used this tax break for the sale of another home within the past two years.

A homeowner can make their second home into their principal residence for two years before selling and take advantage of the IRS capital gains tax exclusion. Deductions for depreciation on gains earned prior to May 6, 1997, will not be considered in the exclusion. Homeowners can take advantage of the capital gains tax exclusion when selling a vacation home if they meet the IRS ownership and use rules.

Even if you use the installment method to defer some of the gain, the exclusion of gain under Section 121 remains available. Refer to Publication 537, Installment Sales, Form 6252, Installment Sale Income, and Topic No. 705, Installment Sales, for more information on installment sales. It feels great to get a high price for the sale of your home, but in some cases, the IRS may want a piece of the action. Here’s how you can minimize or even avoid a tax bite on the sale of your house. If you converted a rental property into your primary residence, your basis would be the lower of your original purchase price or the fair market value of the home on the date you converted its use.

When your cost basis is higher, your exposure to the capital gains tax may be lower. Remodels, expansions, new windows, landscaping, fences, new driveways, air conditioning installs — they’re all examples of things that might cut your capital gains tax. For example, if you bought a home 10 years ago for $200,000 and sold it today for $800,000, you’d make $600,000. If you’re married and filing jointly, $500,000 of that gain might not be subject to the capital gains tax (but $100,000 of the gain could be). By making it your primary residence, in two years you’ll be able to sell while taking advantage of capital gains exclusions. If you sell the home after you hold it for longer than one year, you have a long-term capital gain.

Your capital gains tax rate depends on how soon you sell your house. If you hold the house for one year or less, you pay short-term capital gains. This is taxed as ordinary income, so you’ll pay 10–37%, depending on your household income.

This means that the tax is based on the net amount after expenses that you gain from selling your house. So it does not mean the total amount of money you make from selling your house, but rather the difference between the original purchase price and the sale price. Your ownership period and residency period don’t have to be concurrent. You could rent the home and live there for two years, then purchase it and own it for the remaining three years while living elsewhere. You can use this capital gain exclusion to avoid tax on a home sale over and over, provided that you meet these rules. The two years don’t need to be consecutive, but house-flippers should beware.

What about the primary residence tax exemption?

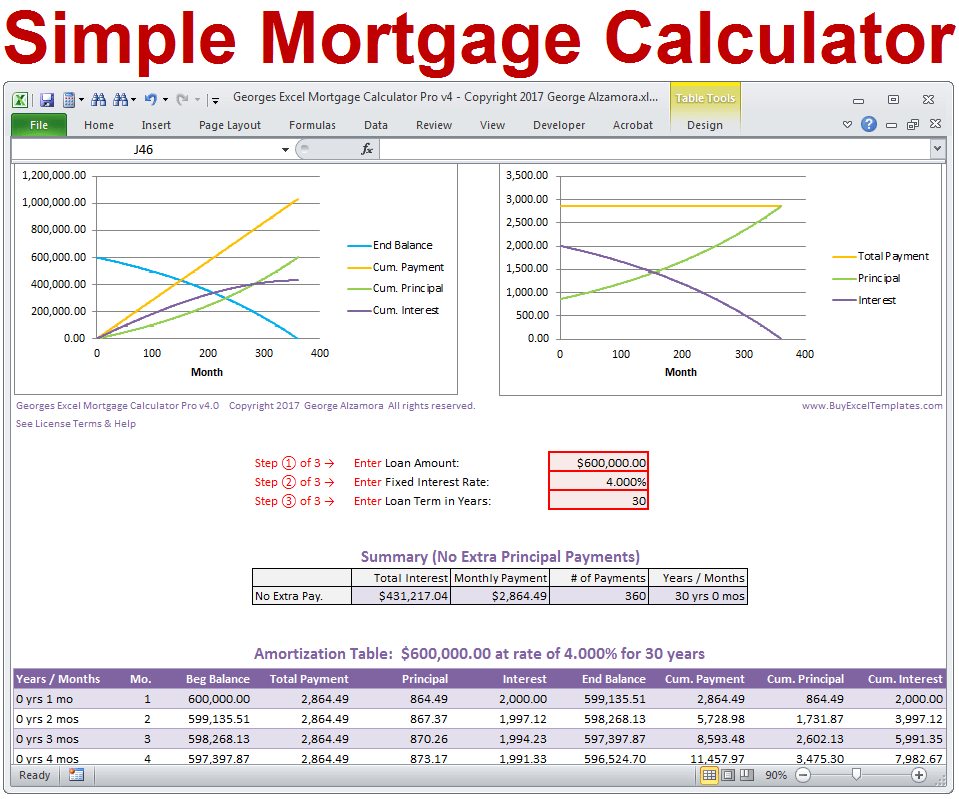

You can use this to determine the amount of capital gains you would be taxed on when selling a second home. However, the sale of second home tax exclusions isn’t the same, as the benefits come with your primary residence. Since your second home isn’t where you live most of the time, you won’t be able to gain financial advantages from this tax exclusion. Let’s look at when you will need to pay capital gains on selling a second home and how much. By understanding the IRS rules, you could potentially cut your tax bill. There will be some situations that require you to pay tax when you sell a property.

Are you wondering how paying capital gains on a second home sale works? If you have a second home and you’ve decided it’s time to sell, you could have a tax bill waiting. Many sellers are surprised that this is true, especially if they live in their homes for years. This is because, before 1997, the only way you could avoid paying taxes on the profits from a home sale was to use it to purchase an even more expensive house within two years. Another, lesser-known option to avoid paying taxes on an investment property sale is through a charitable remainder trust . This option is best suited for retirees who are willing to donate the house to their favorite charity, such as a church or university.

No comments:

Post a Comment